Policing is a dangerous profession.1 The mortality rate among officers is far higher than the U.S. population average, both on the job as well as outside of work and after retirement. In part, this is due to higher rates of victimization (e.g., homicide), but also due to elevated risk of vehicle accidents, heart attacks, and suicide during as well as after shifts. Stressful police duties are associated with a risk of sudden cardiac death that is markedly higher than the risk during routine/nonemergency duties. Restraints/altercations and pursuits are associated with the greatest risk. These findings have public health implications and suggest that primary and secondary cardiovascular prevention efforts are needed among police officers.2 As a result, the average life expectancy of officers is 66 years, which is 22 years shorter than average in the United States (78 years). The mortality rate is even more concerning when examined within specific subgroups that are more prominent in police departments or early retirees. For example, “a male police officer in the 50–54-year age category had close to a 40% probability of death compared to a 1% probability for males in the general population in that same age category.”3

An important, if subtle, implication of this mortality fact is that police may be less likely than average to have estate planning established before death. The most recent statistics on estate planning show 34 percent of U.S. adults in 2024 had completed planning, and only 24 percent of those 34 years old and younger had done so (i.e., the population doing tactical and highest risk policing work). There is no statical information on the prevalence of police-specific estate planning, but, to the degree they follow similar patterns as the general population, it is likely that many will die prior to establishing plans.

Estate Planning

Estate planning is an umbrella term referring to a vast array of legal authorities and decisions governing both the process of dying and events afterward. They include formal decisions and guidance regarding, for example, life insurance, retirement plans and benefits, custody and care of children, trusts and guardianship for special needs dependents, specific bequests (e.g., who will inherit firearms, family heirlooms, vehicles), pensions, property, and executorship.

Estate planning matters. Decisions regarding death represent the last moment of personal agency an individual experiences and is special for that reason alone. But it is important for more practical reasons as well. First, death is time-consuming and expensive absent formal planning. Beneficiary lines on a bank account will lead to control of that account within minutes, and thus the ability to pay for necessary expenses such as a funeral. Absent these lines, an individual is likely to spend weeks or months, pay for legal assistance, and appear in court in order to establish control. Death is hard enough without this burden.

Second, estate planning is also important because it embodies a series of decisions of exceptional impact. This includes the financial well-being of those receiving—or failing to receive—benefits. Inheritance is generally one of the largest wealth transfers that will occur in an individual’s life, often serving as a fundamental determinant of whether a person will be able to purchase a home or not, pay for college or not, take a job of passion or not. But an inheritance also includes a significant and devastating potential harm to family dynamics and well-being in the event of conflict. The latter includes decisions as to when to end life for an officer no longer able to make decisions for themself, as well as financial decisions that have powerful implications for the quality of life of family members and the legacy of that officer.

Estate planning is important in general, but especially in the case of divorces and remarriages, or other family dynamics that make inheritance, executor, and other aspects of estate planning less clear. Police personnel also have high odds of leaving a complicated estate. The U.S. Census Bureau estimates police officers have a similar divorce rate as the general population (around 14.5 percent).4 However, that statistic is misleading in the context of estate planning as it is an average of the divorce rate among first marriages (40–50 percent) and second or greater marriages, which have substantially lower rates. It is likely that many of fallen officers will have complex family situations.5 In addition, police officers tend to have complicated finances. They are likely to have pensions, extended health care benefits, potential federal benefits if killed in the line of duty, and other services and support available from the local and national level and nonprofit sector (e.g., Fraternal Order of Police and similar organizations). Police also are more likely than those in other professions to have also had a military career, which includes similar and additional complicated financial implications.

“Having a plan in place can give both the officer and their family peace of mind, knowing they are prepared for whatever the future may bring.”

Research on officer mortality, as described above, imply estate planning should be important police professionals. However, there are several gaps in existing knowledge that make it difficult to plan policy or offer guidance to agencies and officers regarding the seriousness of this problem. First, there is little direct research on estate planning by police officers; it is not known how many have made plans. Second, there is very little information about planning specifically among officers at higher risk of death, such as those who serve in roles that focus on arrest of serious violent offenders (e.g., fugitive task forces). This is important because the larger issue of estate planning may be less troubling if officers are making informed judgments about if and when to plan. More specifically, it could be that the average police officer considers themself to face little risk in their work (and so are not at great risk of harm for delaying planning) while others tasked with exceptionally dangerous duties face death often (and so, being aware of their risk, plan appropriately). However, it’s unknown if this is the case or not.

Current Study

To address these challenges, a survey was administered to all members of a large, multijurisdictional fugitive task force in the Northeast United States. The survey consisted of a battery of items on three foci: personal and professional background, critical incident exposure, and estate planning questions.

Sample

The police unit was selected in part because of the high-risk nature of their work. As noted above, this should provide a “best case scenario” of estate planning in as much as these task force members face risk more often than most officers (though this does not imply that other officers do not encounter risks). The task force focused almost exclusively on executing fugitive arrest warrants for serious and violent offenders or responding to exigent situations such as mass shootings. The fugitive task force reported, for example, that their members are present in nearly half of all homicide arrests that occur in the states serviced by this team. Similarly, the task force was chosen in part because officers have had higher than average exposure to indirect causes of death. For example, the team comprises officers who were either present in the area or responded to the 9/11 attacks or were trained under officers who were responders to those attacks. The toxic aftermath of those attacks elevated the number of officers who would have been exposed to high mortality rates in policing. Similar arguments can be made for their exposure during the COVID-19 epidemic as the Northeast areas served by this task force experienced waves of infection early in the crisis before protective personal equipment was considered helpful or treatments were developed. The mortality rate among officers was substantially higher than the public, and this would have been especially true among officers serving on this task force. Finally, the task force was selected because of its size and breadth, as this should alleviate some concerns that results may be specific to the peculiarities of a single department in the selection or training of personnel with respect to estate planning. The task force has partnership agreements with a large number of federal, state, or local agencies and 13 fully operational offices spread over two states.

Instrument

A wellness survey was created to address some of these specific questions on estate planning. The survey was sent to 93 operational members of the task force. Sixty-eight members responded. They included items on years of service, children, and marital status. Items were also crafted to describe exposure to death or risk of death. In the latter case, items were adapted from prior research on traumatic experiences of police officers.6 This included asking whether respondents had ever seen a dead body while on the job, been shot or shot at, and injured during a critical incident (e.g., a shooting). Finally, items were crafted to reflect several components of estate planning. This includes whether a health care surrogate was established, beneficiary statements were set up for bank accounts, and a will was filed.

Open to View Questionnaire questions

Q1: Have you ever been involved in Police Involved shooting/Critical Incident?

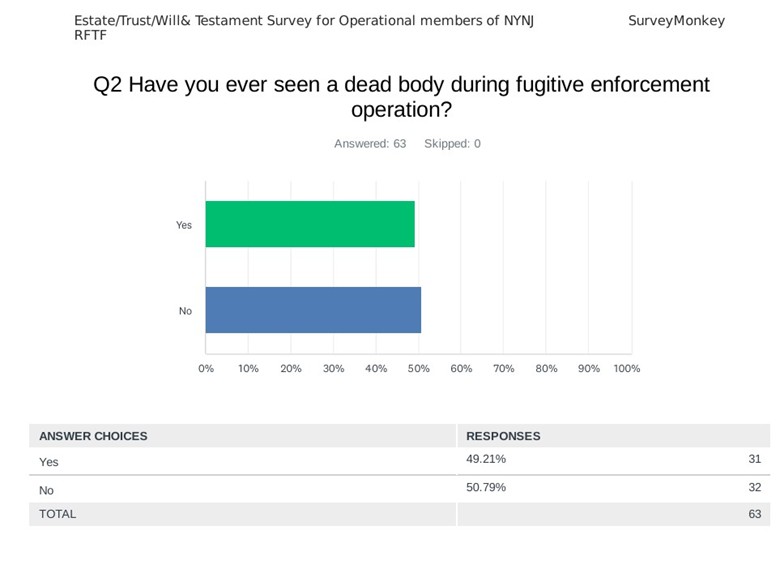

Q2: Have you ever seen a dead body during a fugitive enforcement operation?

Q3: Have you ever seen a severely injured person during a fugitive Investigation?

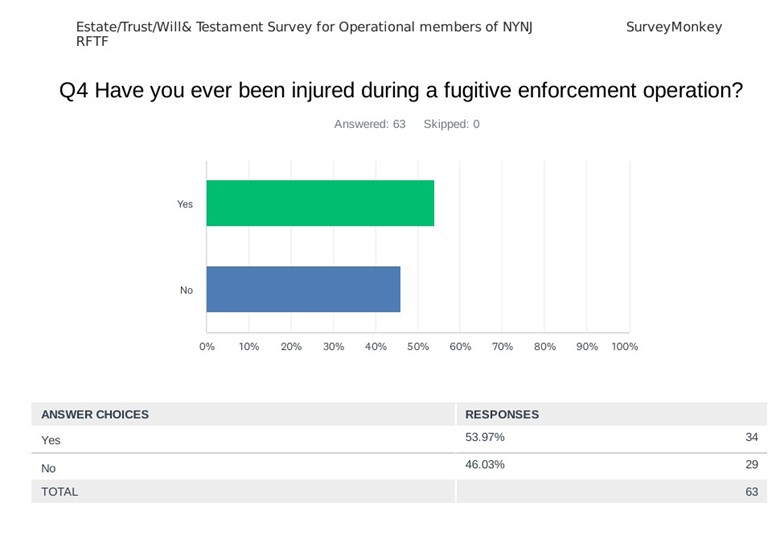

Q4: Have you ever been injured during a fugitive enforcement operation?

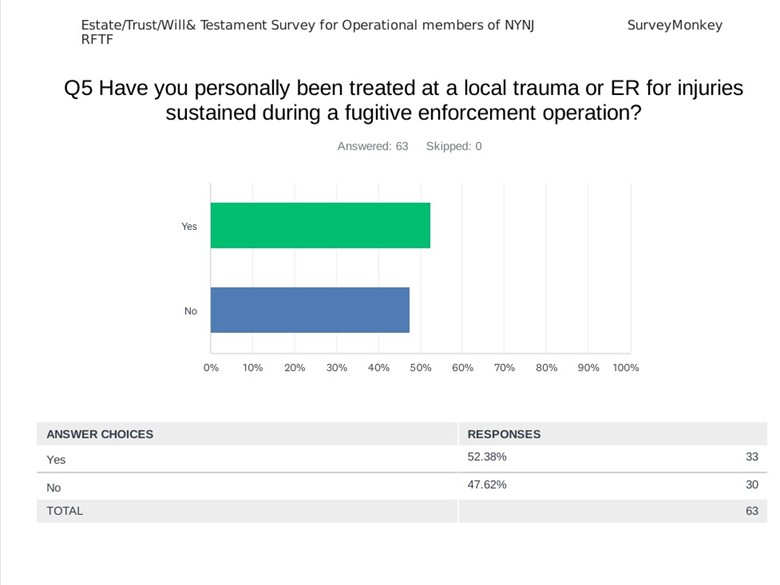

Q5: Have you personally been treated at a local trauma or ER for injuries sustained during a fugitive enforcement operation?

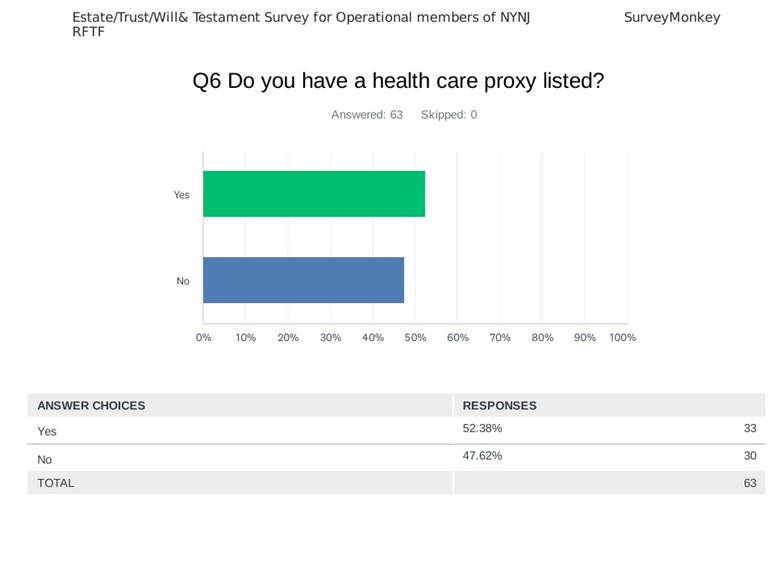

Q6: Do you have a health care proxy listed?

Q7: Do you have life insurance ?

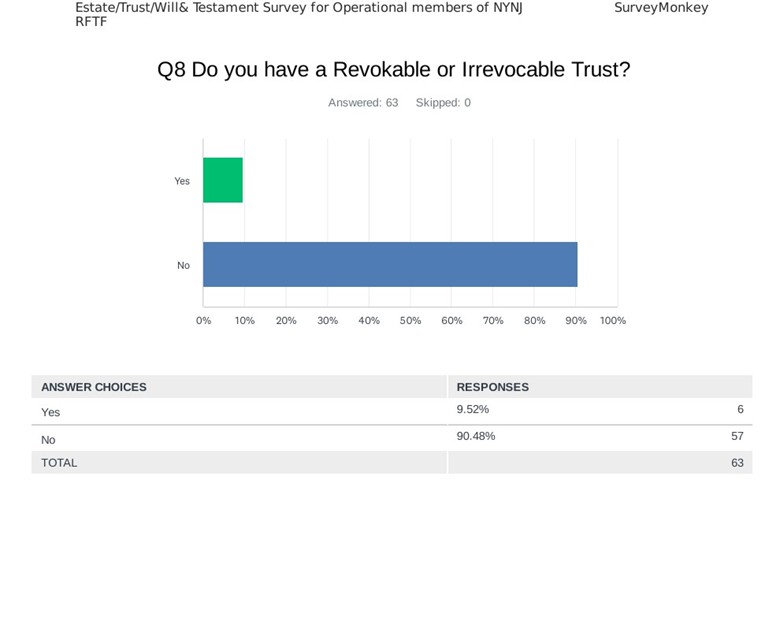

Q8: Do you have a Revokable or Irrevocable Trust?

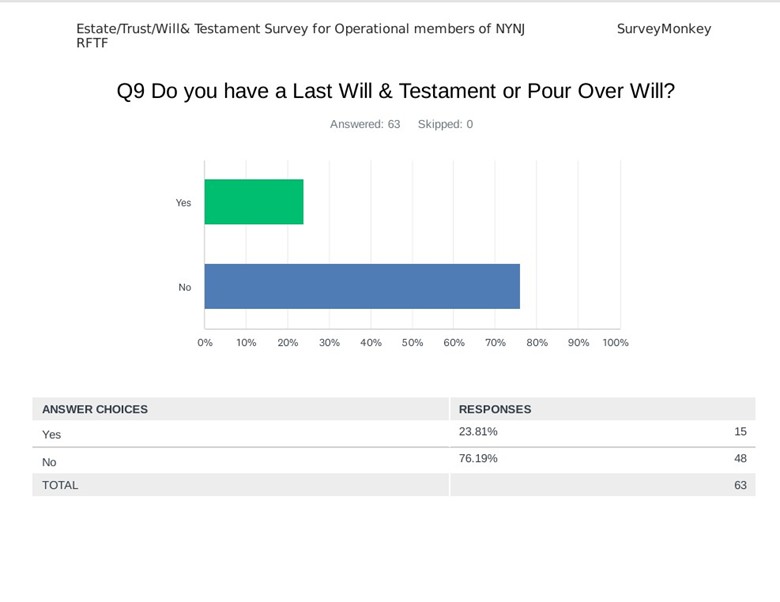

Q9: Do you have a Last Will & Testament or Pour Over Will?

Q10: Do you have Beneficiaries on all your accounts?

Q11: How many children do you have ?

Q12: Are you divorced?

Q13: How many years in Law Enforcement?

Q14: How many years assigned to the NY/NJ RFTF?

Q15: How old are you ?

Q16: How many police/law enforcement funerals for LEOs have you attended?

Q17: If a free consultation or service were available for estate planning/will&testatment/trusts would you attend?

Q18: Add any comments based on this subject/topic

Q19: Have you ever been involved in Police Involved shooting/Critical Incident ?

Q20: Have you ever seen a dead body during fugitive enforcement operation?

Q21: Have you ever seen a severely injured person during a fugitive Investigation?

Q22: Have you ever been injured during a fugitive enforcement operation?

Q23: Have you personally been treated at a local trauma or ER for injuries sustained during a fugitive enforcement operation?

Q24: Do you have a health care proxy listed?

Q25: Do you have life insurance ?

Q26: Do you have a Revokable or Irrevocable Trust?

Q27: Do you have a Last Will & Testament or Pour Over Will?

Q28: Do you have Beneficiaries on all your accounts?

Q29: How many children do you have ?

Q30: Are you divorced?

Q31: How many years in Law Enforcement?

Q32: How many years assigned to the NY/NJ RFTF?

Q33: How old are you ?

Q34: How many police/law enforcement funerals for LEOs have you attended?

Q35: If a free consultation or service were available for estate planning/will&testatment/trusts would you attend?

Q36: Add any comments based on this subject/topic

Results

Most respondents, over 25 percent, had an average age of 25 years in policing. The data also confirmed that the majority had been exposed to lethal or near lethal danger on the job. Of the total respondents, 51 percent had been involved in a shooting, 53 percent had been injured or hospitalized, and 49 percent had been exposed to a dead body on the job.

Open to View Graphs of Results

Regarding estate planning, data showed 23 percent had a will, and 52 percent had a health care surrogate. As theorized, those with a greater level of exposure to mortality signals had more complete estate planning.

Estate Planning Benefits

Attorney Will Andersen is a member of the New York Bar and has extensive experience in the preparation of wills, in the preparation of estate documents, and with the probate process. An interview was conducted by phone with Mr. Andersen to discuss the reasons for and benefits of estate planning for officers, resulting in nine main points.

- Increased Risk of Harm and Fatality

Police officers face a higher than average risk of injury, disability, or death due to the nature of their work. Every day on the job, they encounter potentially dangerous situations that can lead to life-threatening injuries or fatalities. Proper estate planning ensures that their loved ones are protected financially and legally in the event of an untimely death or incapacitation. This is made even more critical by the young age at which some police officers die in the line of duty. Who will be making short- and long-term medical decisions for an incapacitated officer? Who will oversee the financial well-being of the officer, their spouse, and their young children?

“Estate planning presents unique challenges and considerations due to the risks inherent in their profession, the need for tailored legal protection, and the complexities surrounding survivor benefits.”

Line-of-duty death: Estate planning can help ensure that the officer’s family has immediate access to critical benefits, such as death-in-service benefits, life insurance, and other financial resources, should the officer die while on duty. It can ensure that a spouse’s finances are protected in case of a future marriage and that a minor child’s financial future is not affected by any future marriage. If an officer is the sole guardian of children, it is vital that the officer is taking control of who the next parent/guardian will be.

- Financial Security for Loved Ones

Estate planning ensures that an officer’s family is financially secure if the worst happens. This includes the distribution of assets, management of bank accounts, and access to life insurance benefits. Officers who die unexpectedly may leave behind spouses, children, or other dependents who depend on their income for support.

Life Insurance: Officers often have life insurance policies through their department, but they may need additional coverage to fully protect their family’s financial future.

Retirement Plans and Benefits: Police officers may have pensions, 401(k)s, or other retirement plans. Estate planning ensures that beneficiaries are properly named and can access these funds upon the officer’s death.

- Ensuring Custody and Care for Children

If the officer has children, estate planning is essential for appointing a guardian who will take care of them if the officer passes away. This decision is critical, especially for officers who are in dangerous or high-risk roles. Without clear guardianship provisions, the state or a court may intervene and make decisions that might not align with the officer’s wishes.

Minors: A will allows the officer to designate a trusted guardian for their minor children, ensuring that they are cared for by someone the officer knows and trusts. It also allows the officer to designate successors in the event their first choice is unable to act. They can also ensure that the financial side is being handled by the right person and the parenting side is also being handled by the right person. These are not necessarily the same people. Proper estate planning can ensure that the right people will be doing the right job.

Special Needs: If the officer has children with special needs, a trust can be established to ensure that the child’s long-term financial and care needs are met.

- Avoiding Legal Complications

Without a clear estate plan, police officers risk leaving their loved ones with the burden of navigating a complex legal process. Probate—the legal process through which assets are distributed after death—can be time-consuming, expensive, and emotionally taxing for surviving family members. It is also a public process, which, given the sensitive nature of policing, can be problematic.

Avoiding Probate: A revocable living trust allows assets to be passed directly to beneficiaries without the need for probate, ensuring a smoother transition of assets and lessening the burden on surviving family members.

Clear Instructions: Having a will in place ensures that there are clear instructions on how the officer’s assets are to be distributed. Without this, state laws will dictate who inherits the officer’s estate, which may not align with their wishes.

- Protecting Assets and Family Interests

Police officers often accumulate valuable assets over time—homes, vehicles, investments, retirement accounts, and more. Estate planning helps to protect these assets and ensure they are distributed according to the officer’s wishes.

Asset Protection: Estate planning tools such as trusts can help shield assets from creditors or lawsuits, providing extra security for the officer’s family. Officers can make sure that future spouses do not have access to the wealth the officers accumulated for their families. (This can extend to the future spouses of children, as well.)

Specific Bequests: Officers can designate who will inherit specific items (e.g., firearms, family heirlooms, vehicles), helping to prevent family disputes or confusion after their death.

- Health and Medical Decision-Making

Estate planning includes creating documents that outline health care decisions in the event the officer becomes incapacitated due to injury or illness. These documents give clarity and control to the officer and their loved ones, specifying the officer’s wishes for medical care and appointing someone to make health care decisions on their behalf if they are unable to do so.

Health Care Power of Attorney (POA): A trusted individual can be given authority to make medical decisions on the officer’s behalf.

Living Will: This document specifies an officer’s wishes regarding life support, organ donation, and end-of-life care if they are incapacitated and unable to communicate.

- Estate Planning for Survivors

Police officers’ families may face emotional and financial challenges in the event of the officer’s injury or death. Estate planning can ease these burdens by ensuring security and support for the officer’s family.

Financial Security: Estate planning can designate the appropriate beneficiaries to ensure the officer’s family has the financial resources needed to cover expenses such as funeral costs, medical bills, and daily living expenses.

Emotional Support: Estate planning can help alleviate some of the emotional strain on survivors by making sure there’s a clear plan in place, avoiding the need for additional decision-making during an already difficult time.

- Access to Benefits and Retirement Plans

Police officers often have access to unique benefits through their departments, including pensions, survivor benefits, and other specialized plans. However, these benefits can be complicated, and estate planning helps to ensure that the officer’s family knows how to access these benefits, how to designate beneficiaries, and how to maximize available support.

Pension and Survivor Benefits: Many departments provide death benefits to the surviving spouse or children of fallen officers. Estate planning helps ensure the family understands how to access these benefits.

Line-of-Duty Death Benefits: Some officers are eligible for additional benefits if they die in the line of duty. A comprehensive estate plan will ensure that these benefits are claimed and distributed properly.

- Peace of Mind

Last, estate planning offers peace of mind. Knowing that their financial affairs are in order and that their families will be cared for in their absence allows officers to focus on their work without worrying about what will happen to their loved ones if something were to go wrong.

Clarity and Certainty: By clearly outlining their wishes, police officers can ensure their families won’t have to navigate a complex, uncertain situation in the event of their death or incapacitation.

Sense of Control: Estate planning allows officers to retain control over how their legacy is handled and ensures that their values and priorities are respected.

Conclusion

Estate planning is a critical aspect of personal financial management that ensures the effective transfer of assets and the fulfillment of an individual’s wishes after death. For police officers, however, estate planning presents unique challenges and considerations due to the risks inherent in their profession, the need for tailored legal protection, and the complexities surrounding survivor benefits. Estate planning for police officers is vital to ensure that their wishes are honored, their families are cared for, and their loved ones don’t face unnecessary legal or financial hurdles. Consulting with an experienced estate planning attorney familiar with the unique aspects of police work and related benefits can help create a comprehensive plan. Having a plan in place can give both the officer and their family peace of mind, knowing they are prepared for whatever the future may bring. Policing is a dangerous profession, making it a field in which estate planning is especially important.

Recommendations

The findings of the survey were shared with the task force’s operational research staff. One key area of recommendation is to replicate this survey on all the fugitive task force units throughout the United States. After evaluating the survey results, executive leadership should partner with police organizations such as the Federal Law enforcement Officers Association and the International Association of Chiefs of Police to host in-service orientations to fugitive investigators assigned to task forces that covers estate planning.

A central support body, such as the IACP or another nonprofit, should provide estate planning forms and guidance. Police chiefs should be encouraged to allow officers a certain number of work hours to establish their estate planning.

To ensure this issue is appropriately addressed, police chiefs and research entities should measure planning statistics in order to help agencies see problems emerging or to identify agencies that are successful who can then serve as models for others to follow.

This effort would benefit from collaboration with police-related charity organizations to expand the awareness and need for police estate planning, as well as collaboration with estate planning attorneys who are willing to speak at police events. Inviting surviving spouses, relatives, and family members of police officers who had to deal with probate predicaments after their family member was killed in critical or traumatic events may help drive the impact home for officers. Finally, collaboration with media, podcasts, and social media platforms can help to spread awareness of this commonly overlooked issue. d

Notes:

1John M. Violanti et al., “Hidden Danger: A 22-Years Analysis of Law Enforcement Deaths Associated with Duty-Related Illnesses,” Policing 43, no. 2 (2020): 330–344.

2Vasilea Varvarigou et al., “Law Enforcement Duties and Sudden Cardiac Death Among Police Officers in United States: Case Distribution Study,” BMJ 349 (2014): g6534.

3John M. Violanti et al., “Life Expectancy in Police Officers: A Comparison with the US General Population,” International Journal of Emergency Mental Health 15, no 4 (2013): 223.

4Gretchen Livingston, “Chapter 2: The Demographics of Remarriage,” in Four-in-Ten Couples Are Saying “I Do” Again (Pew Research Center, 2014).

5Shawn P. McCoy and Michael G. Aamodt, “A Comparison of Law Enforcement Divorce Rates with Those of Other Occupations,” Journal of Police and Criminal Psychology 25 (2010): 1–16.

6Daniel S. Weiss et al., “Frequency and Severity Approaches to Indexing Exposure to Trauma: The Critical Incident History Questionnaire for Police Officers,” Journal of Traumatic Stress 23, no. 6 (2010): 734–743.

Please cite as

Sandy Rao, “The Perils of Neglecting Estate Planning,” Police Chief Online, May 21, 2025.